Amortization vs Depreciation: What’s the Difference?

This means that GAAP changes in value can be accounted for through changing amortization schedules, or potentially writing down the value of an intangible, which would be considered permanent. Finally, GAAP stipulates that advertising expenditures be expenses as incurred, but IFRS does allow how to estimate your 2021 tax refund recognizing a prepayment of these expenses as an asset, which would be capitalized or amortized as they are used at a later date. A more specialized case of amortization takes place when a bond that is purchased at a premium is amortized down to its par value as the bond reaches maturity.

Start with Net Income

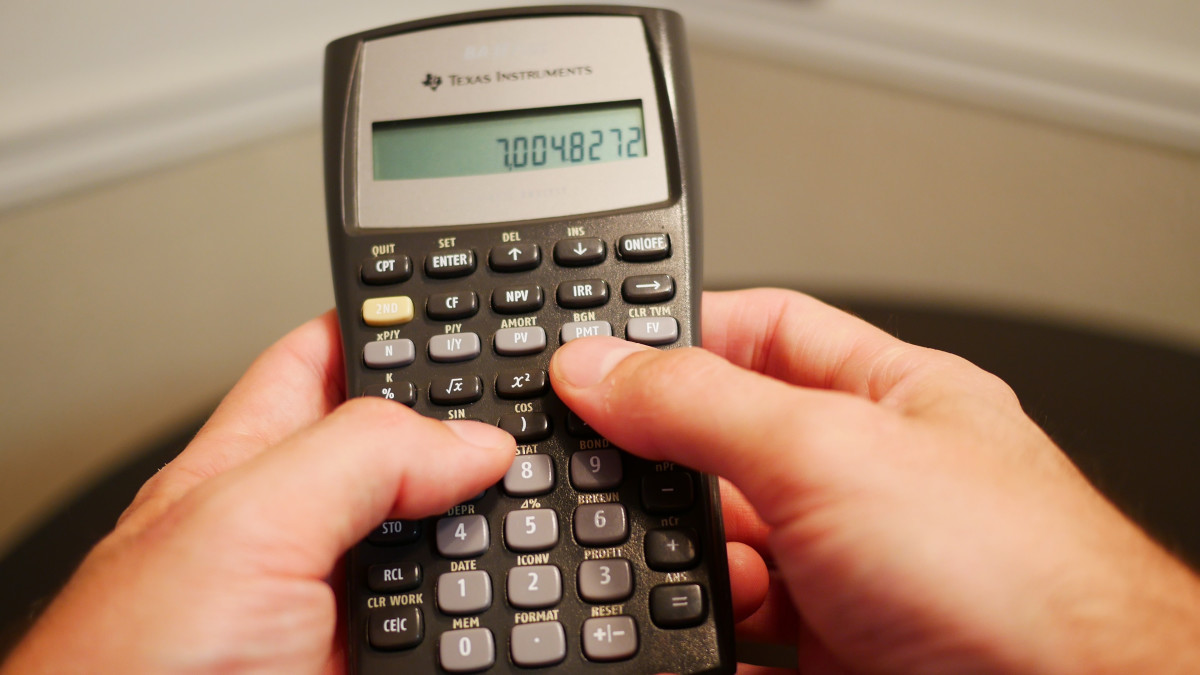

Next, you prepare an amortization schedule that clearly identifies what portion of each month’s payment is attributable towards interest and what portion of each month’s payment is attributable towards principal. Accountants use amortization to spread out the costs of an asset over the useful lifetime of that asset. Next, our company’s long-term debt balance was assumed to be $80m, which is decreased by the mandatory debt amortization of $5m.

The Ultimate Cash Flow Guide (EBITDA, CF, FCF, FCFE, FCFF)

Net earnings from the income statement are the figure from which the information on the CFS is deduced. But they only factor into determining the operating activities section of the CFS. As such, net earnings have nothing to do with the investing or financial activities sections of the CFS.

Depreciation & Amortization

Depreciation applies to expenses incurred for the purchase of assets with useful lives greater than one year. A percentage of the purchase price is deducted over the course of the asset’s useful life. “So far this year, we’ve generated $103 million in operating cashflow, enabling us to reinvest in our core, and to explore new markets and growth verticals, all while improving our balance sheet and paying down debt. “Our focus remains the same, win in strategic markets with a brand portfolio consumers love, provide best-in-class retail operations and maintain a relentless pursuit of financial strength. Our Q3 results underline the success of this strategy with $180 million in revenue at 29% adjusted EBITDA margin1, and most importantly $49 million of operating cashflow, our highest ever. Cash flows from operating are generally the cash effects of transactions and other events that enter into the determination of net income.

Propensity Company had a decrease of $1,800 in the currentoperating liability for accounts payable. The fact that the payabledecreased indicates that Propensity paid enough payments during theperiod to keep up with new charges, and also to pay down on amountspayable from previous periods. Therefore, the company had to havepaid more in cash payments than the amounts shown as expense on theIncome Statements, which means net cash flow from operatingactivities is lower than the related net income.

See the end of this press release for a reconciliation of revenue, excluding political advertising revenue, to revenue. Checking a company’s free cash flow (FCF), and especially checking the trend of free cash flow over time, can be useful to investors considering a company’s stock. Shareholders can use FCF as a gauge of the company’s ability to pay dividends or interest, while lenders may use it as a measure of a company’s ability to take on additional debt. Free cash flow indicates the amount of cash generated each year that is free and clear of all internal or external obligations. While a healthy FCF metric is generally seen as a positive sign by investors, context is important. A company might show a high FCF because it is postponing important CapEx investments, which could end up causing problems in the future.

Net cash flow from operating activities is the net income of thecompany, adjusted to reflect the cash impact of operatingactivities. Positive net cash flow generally indicates adequatecash flow margins exist to provide continuity or ensure survival ofthe company. The magnitude of the net cash flow, if large, suggestsa comfortable cash flow cushion, while a smaller net cash flowwould signify an uneasy comfort cash flow zone. When a company’snet cash flow from operations reflects a substantial negativevalue, this indicates that the company’s operations are notsupporting themselves and could be a warning sign of possibleimpending doom for the company. Alternatively, a small negativecash flow from operating might serve as an early warning thatallows management to make needed corrections, to ensure that cashsources are increased to amounts in excess of cash uses, for futureperiods. The direct method of calculating cash flow from operating activities is a straightforward process that involves taking all the cash collections from operations and subtracting all the cash disbursements from operations.

- Such a tangible asset is depreciated; in other words, the value of the asset reflected on the balance sheet is reduced to reflect its lower value.

- Depreciation can be somewhat arbitrary which causes the value of assets to be based on the best estimate in most cases.

- If you’re an investor, this information can help you better understand whether you should invest in a company.

- Instead, depreciation and amortization represent the reduction in the economic cost of the asset over time.

- Next, you prepare an amortization schedule that clearly identifies what portion of each month’s payment is attributable towards interest and what portion of each month’s payment is attributable towards principal.

Free Cash Flow to the Firm or FCFF (also called Unlevered Free Cash Flow) requires a multi-step calculation and is used in Discounted Cash Flow analysis to arrive at the Enterprise Value (or total firm value). FCFF is a hypothetical figure, an estimate of what it would be if the firm was to have no debt. CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path.

One of the biggest shifts in the economy is the rise of intangible assets such as software, data, and subscription (SaaS) businesses growing in the market. While the shift from fixed to intangible assets has been swift, the accounting changes have not followed suit. Let’s look at a simple example to illustrate how the items work and their impacts on the income statement. The accounting for both depreciation and amortization is essentially the same, and for our example, I would like to look at the amortization of goodwill. Almost all intangible assets are amortized over their useful life using the straight-line method. The key difference between amortization and depreciation involves the type of asset being expensed.

Each of these valuation methods can use different cash flow metrics, so it’s important to have an intimate understanding of each. Operating cash flow does not include capital expenditures (the investment required to maintain capital assets). Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy. Under U.S. GAAP, interest paid and received are always treated as operating cash flows.

We believe this measure is an important indicator of the Company’s operational strength and performance of its business because it provides a link between operational performance and operating income. It is also a primary measure used by management in evaluating companies as potential acquisition targets. Cash provided by operating activities was $102.8 million, compared to $96.2 million in the prior year period primarily due to the increase in political revenues, largely offset by a decrease in broadcast revenue. Free Cash Flow was $73.3 million, compared to $67.7 million in the prior year period.